London is the world’s biggest centre for investment in the minerals industry. Investment banks, pension funds, hedge funds and insurance companies use London stock exchanges to invest in dubious mining projects across the globe. Going by stock value, half of the world’s large mining companies are in some way connected to London – which also makes it an important hub for environmental justice organizations.

The London Mining Network (LMN) is an alliance of human rights, development and environmental groups that links the money to the metals and especially to the people that live around the place where the metals are taken from. The broad coalition has members such as Catapa, Corporate Watch and the Gaia Foundation. Through the LMN they expose the role of companies listed on the London Stock Exchange, London-based funders and the British Government in the promotion of unacceptable mining projects. Richard Solly, Coordinator of the London Mining Network just wrote a blog on the kind of activism that the LMN is good at: shareholderactivism. Here’s the introduction to his most recent blog:”

By Richard Solly.

Fans of the now-ancient British television series Monty Python’s Flying Circus may remember an interview with a Mr Polevaulter, whose speciality is contradiction. It begins:

“Mr Polevaulter, when did you start contradicting people?”

“But I didn’t!”

“You told me you did!”

“I most certainly did not!”

And so on.

It was like that at question time at the Antofagasta AGM on Wednesday.

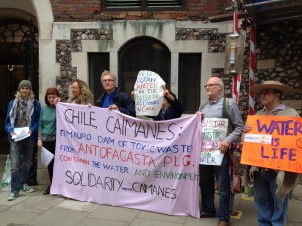

Antofagasta is a Chilean company listed on the London Stock Exchange. Several activists attended to convey the concerns of mine opponents at Caimanes in northern Chile, affected by the operations of the company’s Minera Los Pelambres copper mine. Local people are suffering because of reduced water supply, contamination of water and the risk of catastrophe if a huge dam containing a tailings (mine waste) pond collapses. There are also worries about damage to important archaeological remains.

The company’s response to almost every concern raised was to contradict the information provided and deny that there was a problem – or that if there was, it was not of the company’s making.

We could summarise the dialogue as follows:

Us: Why spend so much money on lawyers attacking the people of Caimanes who are only trying to defend their livelihoods in the face of pollution and water scarcity?

Them: But we’re not: they’re attacking us – we’re just defending ourselves.

Us: Since you built the tailings dam, there has been an 80% reduction in water availability.

Them: No, there hasn’t.

Us: The remaining water has been dangerously polluted.

Them: No, it hasn’t.

Us: The tailings dam is poorly constructed and is vulnerable to collapse because of seismic activity.

Them: No, it isn’t.

Us: You’re not looking after valuable archaeological finds properly.

Them: Yes, we are.

Us: But you’re breaking Chilean law. Barrick Gold has just had its operations suspended, been fined and suffered a drop in share price because it broke Chilean law.

Them: Well… Chilean archaeologists think we are doing a brilliant job.

Us: Oh no, they don’t…

Other shareholders spoke about the fact that, contrary to recommended practice in the UK, the company has an Executive Chairman rather than a Chief Executive Officer and an independent Chairman; and that it is controlled by one family, the Luksic family, the wealthiest family in Chile. Two other London-listed companies have received massive negative publicity in recent years for similar arrangements: Vedanta has now separated the roles of Chairman and Chief Executive but is still controlled by one family, the Agarwals from India; and Bumi’s domination by the Indonesian Bakrie family has caused shareholders no end of trouble since it listed in London. So, for Antofagasta, there may be trouble ahead

To read the full article, go here: http://londonminingnetwork.org/2013/06/flat-contradiction-no-meeting-of-minds-at-the-antofagasta-agm/